1inch Investment Fund, a fund closely tied with the crypto exchange aggregating platform, 1inch, has sold 4,685 stETH for 8.54 million USDC at $1,823, according to Scopescan, an analytics platform, on October 24. By selling at spot rates, the fund has netted $1.28 million in profits since the stETH was bought at an average price of $1,550 less than a week ago.

1inch Investment Fund Sells stETH

StETH, or staked Ethereum (ETH), is an ERC-20 token representing staked ETH on the Lido Finance protocol. The platform allows anyone to stake their coins and earn rewards without necessarily locking their coins for an extended period.

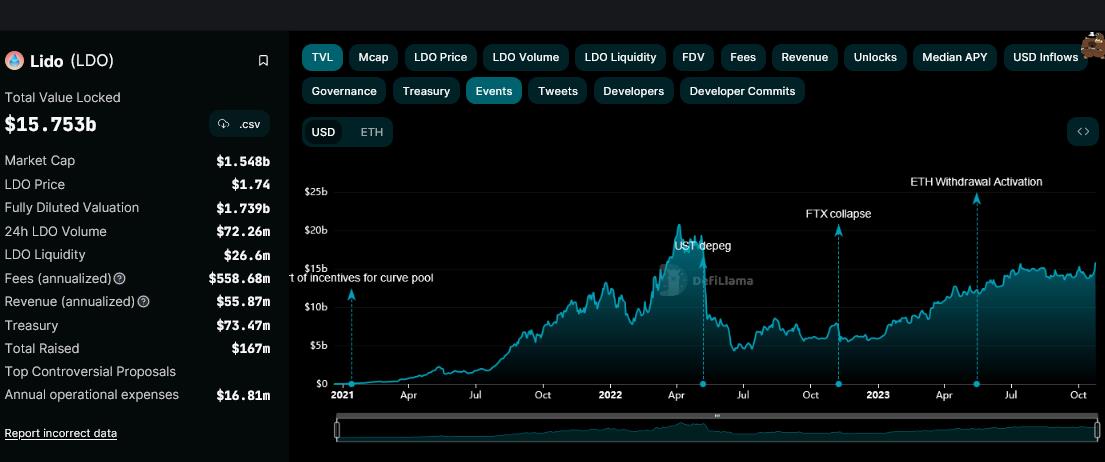

As of October 24, Lido Finance is the most popular decentralized finance (DeFi) application looking at total value locked (TVL). DeFiLlama data shows that the protocol manages over $15.7 billion of assets, of which over 95% are ETH.

Technically, any ETH holder wishing to stake and earn network rewards stake on Lido Finance receives stETH in return, representing the stake amount. The higher the staked amount, the more stETH the protocol issued. This stETH can be traded, transferred, or used to secure loans while concurrently earning network rewards.

Selling stETH means 1inch Investment Fund automatically unstaked the same amount on Lido Finance and sold the underlying coins. Even so, transferring the underlying ETH can take several days when there might be changes to spot prices.

Curiously, the decision is when the crypto market seems to recover, and Ethereum is roaring back to life towards the $2,000 level. Considering that the fund is private and doesn’t divulge its strategy to the public, it couldn’t be immediately determined why it sells stETH when market confidence is high.

Will Ethereum Prices Break $2,000?

Looking at price charts, Ethereum prices are up roughly 17% from H2 2023 lows, rallying at spot rates. The October 23 and 24 expansion has seen the coin break higher, registering new October highs. Even so, despite the overall confidence, the failure of bulls to complete reverse losses of August 17 should be a concern.

Ideally, a comprehensive surge above $1,800 and $2,000 could anchor a leg up toward $2,100 in the coming sessions. When the fund sold stETH at $1,823, price data showed it exited at around today’s peak. There is an inverted hammer in the ETHUSDT daily chart, an indicator that prices are inching lower on increasing selling pressure.

--------------------------------------------------

By: Dalmas Ngetich

Title: 1inch Investment Fund Just Sold Ethereum, What Do They Know?

Sourced From: www.newsbtc.com/news/ethereum/1inch-investment-fund-sold-ethereum-what-do-they-know/

Published Date: Wed, 25 Oct 2023 04:00:49 +0000

.png)